Our philosophy is to focus on the most effective blend of Risk, Return and Expenses.

MPS LORIA is 100% independent, offering clients access to most investment choices creating “Best of Breed” strategies within client portfolios. Your portfolio will utilize both active and passive strategies through Mutual Funds, Exchange Traded Funds (ETFs) and Individual Stock and Bond Separate Accounts. Our focus is on low expense, no commission strategies using some of the largest custodians in the industry to hold your assets. Through routine Investment Committee meetings we provide both initial & on-going monitoring on investment strategies and portfolio construction along with detailed allocation and performance reporting.

Annual Review

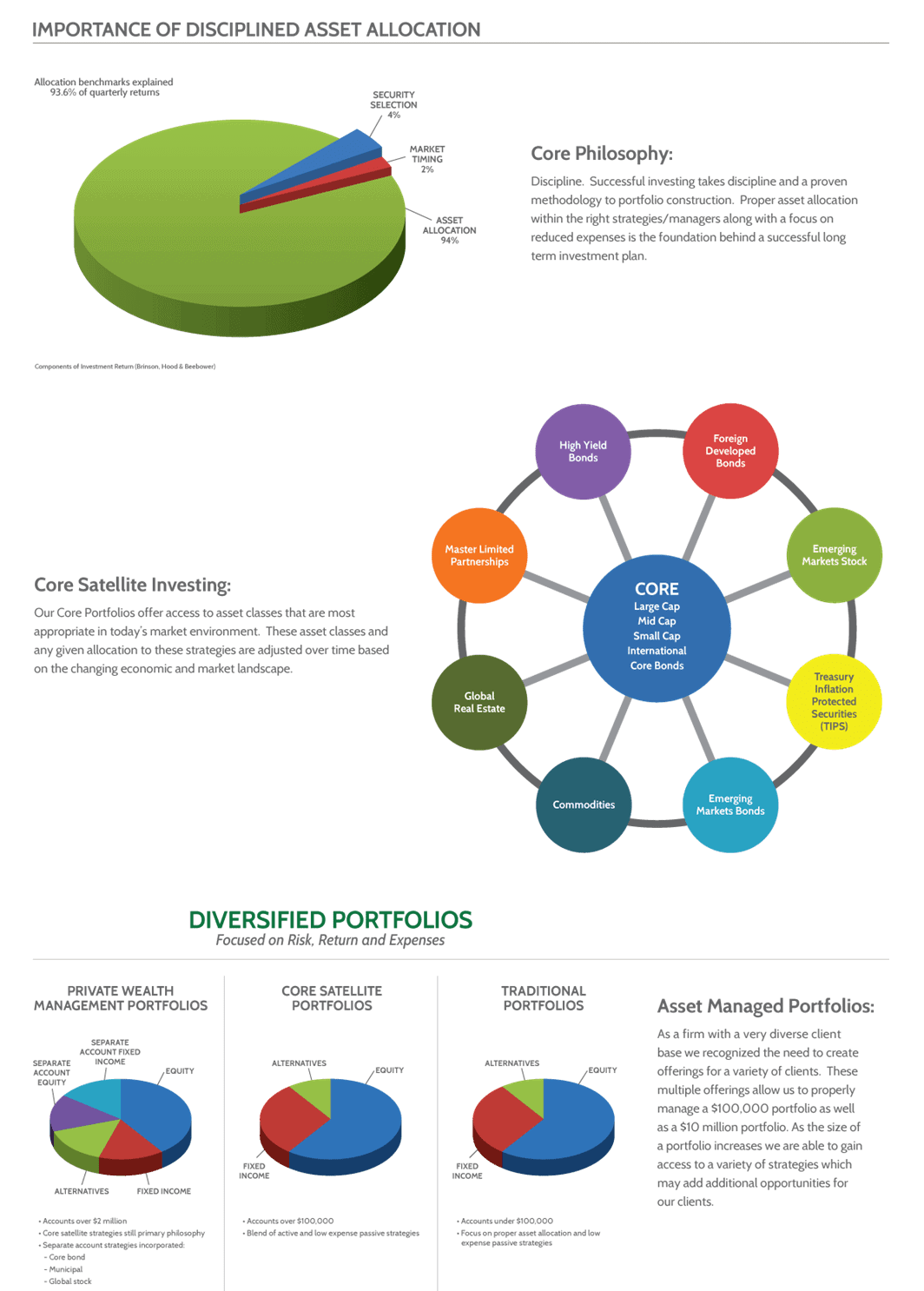

Asset Allocation

Asset Management

Being 100% independent has advantages for our clients in that we do not have an agenda regarding what strategies or managers we utilize. Each quarter we hold an Investment Committee meeting where we utilize the services of a large, established research firm to confirm proper portfolio construction as well as a comprehensive review of each manager and strategy in the portfolio. Relative to the industry, this approach of blending active and passive strategies allows us to minimize expenses to clients but still gain opportunities through proven active managers.

*Components of Investment Returns (Brinson, Hood & Beebower, 1986)