Pension Advisory Services

MPS LORIA Financial Planners, LLC provides investment retirement plan consulting services to a wide array of clients.

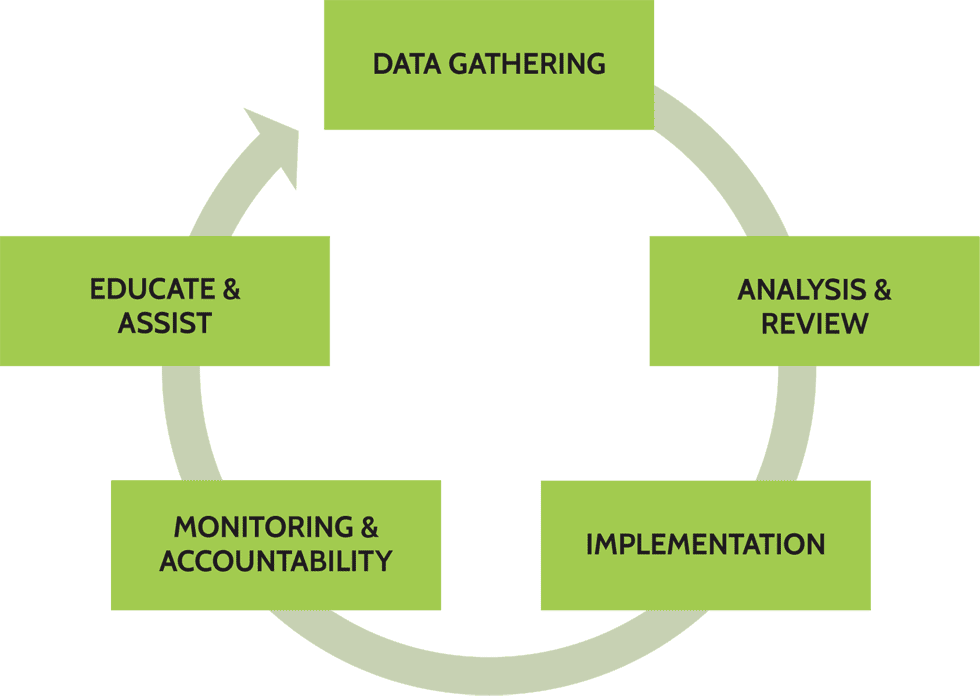

Our Process

- Analyze plan investments and recommend improvements.

- Implement appropriate investment platform and options.

- Provide on-going service and monitoring of investments.

- Analyze and benchmark plan expenses.

- Educate and assist with investment advisory needs.

As an independent firm, we offer objective advice that is conflict free and in the best interest of our clients. We follow a prudent approach in identifying, selecting, and monitoring best-in-class investment managers. We promote a culture of fiduciary responsibility and transparency.

Disclosure: Neither MPS LORIA nor any of its affiliates provide trustee, tax/accounting, legal, regulatory compliance or Third Party Administrator services. All plan design, testing, compliance and tax filings are the responsibility of the Trustee or a qualified Third Party Administrator.

Group Health Benefits Services

MPS LORIA Financial Planners, LLC provides consulting, advisement and the placement of insurance policies for employers and individuals. Medical, Dental, Life, Disability and Long Term Care all on a group and individual basis. Our goal is to provide you with the level of risk protection you are comfortable with at the least costly, tax advantaged basis. For employers, we assist you, and your employees, with your benefit needs and questions. We serve as your Independent Benefits experts, so you do not have to be, in the new and complicated world of ACA (Affordable Care Act) rules and regulations.

Our Process

- Review, discuss, advise and design employee benefit programs that meet your needs.

- Procure insurance policies to provide desired benefits for eligible employees and families.

- Communicate benefit programs to employees and provide ongoing support and assistance to them and their dependents.

- Introduce tax advantaged methods to minimize employer and employee costs through the effective use of FSAs (Flexible Savings Account), HSAs (Health Savings Account) and HRAs (Health Reimbursement Account).

- Review feasibility of self-funded group medical plans for small employers negatively impacted by ACA required Community Rating

- Provide self-funded policy advisement and assistance to large employers, as well as help with TPA (Third Party Administrator) selection.

- Negotiate and advise renewal plan options.

- Support and assist you and your employees on each and every benefit issue throughout the policy year.

- Advise and assist those transitioning to Medicare coverage on proper plan options and choices.

With the recent and ongoing changes, companies & individuals will need professional advisors to be current in insurance product knowledge and knowledge of the changing laws under ACA to give prompt and correct advice. Our MPS LORIA team will put your best interests first when recommending any insurance products and/or services.

Want to review your individual health plan choices? Click here to view options from Blue Cross Blue Shield Of Illinois.